Bridge Contract

The bridge contract interacts with the rollup to facilitate bridging between Mantis (the L2) and its L1, Solana. This occurs over the Inter-Blockchain Communication (IBC) Protocol. The bridge contract connects to an IBC contract to facilitate this connection. A relayer is also used to send information between the Mantis rollup and Solana.

Deposits

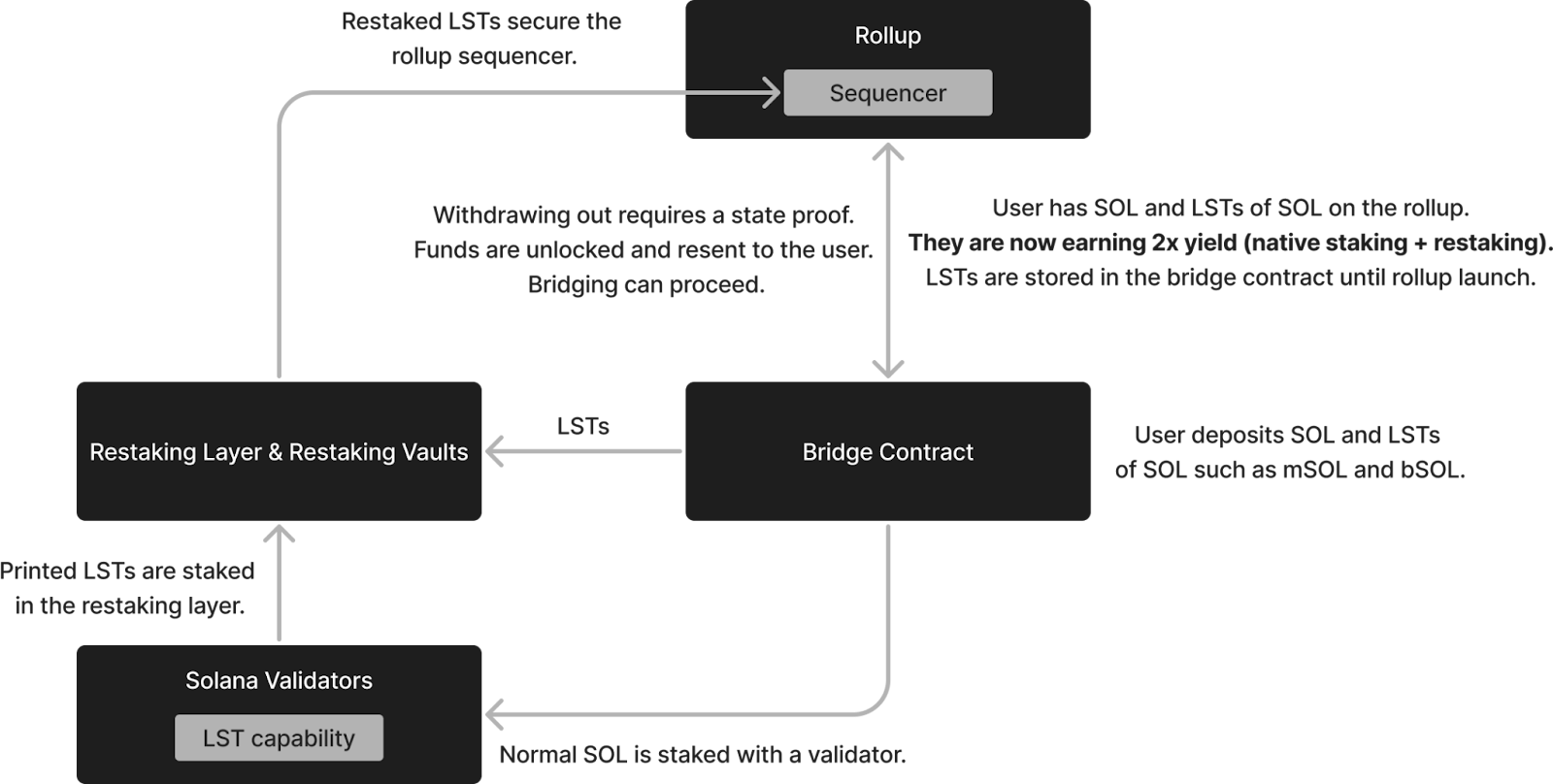

A bridge contract interacts with the Mantis rollup to facilitate the movement of assets. Any asset can be deposited into the bridge contract to be staked in proof-of-stake validation and provide staking rewards. Deposits of SOL or any of a number of liquid staked tokens (LSTs) from SOL earn additional yield in the form of restaking, DeFi integrations, and native yield:

Restaking

Accepted assets: SOL and SOL-based LSTs

SOL deposited into the Mantis bridge contract is staked with Solana validators for proof-of-stake validation in Picasso’s Restaking Layer. Staked SOL will be represented by an LST. Users can then choose to also restake their LSTs into the Solana Restaking Layer. This provides doubled staking yield while abstracting away the additional steps for users to perform restaking on their own.

Any LSTs that have been directly deposited into the bridge contract also flow to the restaking vault. The resulting crypto-economic security can be leveraged by the Mantis rollup and other Actively Validated Services (AVSes) paying for this security.

Tokens that have been restaked in this Restaking Layer will be used to secure the sequencers of the Mantis Solana-based rollup.

DeFi Integrations

Accepted assets: SOL-based LSTs and Solana native stablecoins

LSTs generated from staking SOL via the bridge contract are deposited into lending protocols, initially marginfi. This provides the user with additional yield.

Any Solana-native stablecoins deposited into the bridge contract will also be routed to these lending protocols. The user can then choose to restake their stablecoins into the Solana restaking layer. This also results in double yield for the user.

Native Yield

Accepted assets: SOL or any assets in Mantis Accounts on the Mantis rollup

Users can stake SOL tokens directly into mantis.app. These SOL are then delegated on the backend to Solana validators. This will allow users to accrue native yield, just as they normally would from using their SOL for proof-of-stake validation on Solana. Users will also receive an LST to represent their SOL stake. Users will earn additional rewards from opting into restaking this LST. This enhances their overall yield from the same amount of underlying assets.

Mantis Accounts also facilitate native yield for other asset types. Mantis Accounts are network-level accounts that can be used for participating in on-chain actions. Mantis Account users will earn native yield for any assets deposited to the Mantis rollup from their account. Therefore, assets held in Mantis Accounts earn yield even when not actively being used.

Native staking and restaking in Mantis can be combined in the Mantis framework streamlining the (re)staking process for users:

Native yield refers to the rewards users earn on their assets on the Solana L1 whilst operating on the Mantis L2. In Season 2, all assets in Round 1 are routed to MarginFi, allowing users to earn yield on their tokens by lending them out. Sources of yield:

- SOL converted to jitoSOL which generates PoS yield. This jitoSOL amount is then deposited into MarginFi and thereafter the Picasso Restaking layer.

- Stablecoins and LSTs are deposited into MarginFi and a representation of this stake is restaked in the Picasso Restaking Layer for additional yield.

If you’ve deposited a stablecoin or liquid staking token eligible for native yield, your token balance will automatically rebase after the launch of the rollup. For deposits of SOL or jitoSOL, you can access and view your yield earned at any time when you choose to withdraw your tokens.

SOL on Mantis

SOL is the gas token of the Mantis rollup and can be used to pay network fees. To receive SOL on the rollup, you can bridge SOL or jitoSOL from Solana. The value of SOL on the Mantis rollup is equivalent to the value of jitoSOL, this is because the

Withdrawals

Withdrawals of (re)staked tokens are done as IBC transfers. Funds are unlocked and sent back to the user in the form in which they were deposited except for SOL where users have the option to receive jitoSOL or SOL on Solana. The user can then bridge their tokens to other locations or perform other functionalities with them again over IBC.

During Mantis Season 2, after you pre-fund your account, your funds can be withdrawn at any time; however, your rewards will be slashed proportionally. For example, if you have earned 100 Credits based on your deposit and decide to withdraw 50% of your deposit, 50 Credits will be slashed from your rewards. Further, you will not be able to claim any native yield until the launch of the rollup.

Escrow Contract

The Rollup has an escrow contract similar to those on Ethereum and Solana. Users can escrow their funds directly on the Rollup. Solvers will also have funds on the Rollup, enabling cross-chain intents to happen directly on the Rollup, within a single chain (like Ethereum), or across chains (e.g., Ethereum to Solana).

SVM and Sequencer

The Mantis rollup’s execution engine is a lightweight Solana Virtual Machine (SVM) with a sequencer similar to the Jito validator client. The sequencer interacts directly with the bridge contract on Solana mainnet for unlocking and routing funds to other chains. The role of the sequencer on Mantis is to produce blocks for the Mantis rollup. It does not post data to the L1, as traditional sequencers do. Instead, this task is performed by an IBC relay.